Our Debt Relief Services

At National Debt Relief, we offer a wide range of expert debt management solutions tailored to help you regain control over your finances. Whether you’re struggling with credit card debt, personal loans, business loans, or facing creditor harassment, our experienced consultants provide personalized support to negotiate settlements, restructure payments, and protect your assets

Debt Relief Program

Our comprehensive Debt Relief Program is designed to assist individuals overwhelmed by multiple debts. Through this program, we evaluate your entire debt portfolio and negotiate settlements or consolidate it into a manageable repayment plan.

Combines debts into one payment.

Negotiates better terms.

Creates a clear payoff plan.

Credit Card Debt Relief

Credit card debt often comes with high interest rates that can quickly spiral out of control. Our Credit Card Debt Relief service targets this issue by negotiating settlements and restructuring repayment plans tailored to your financial situation.

Settles debts at lower amounts.

Reduces monthly payments.

Protects credit scores.

Personal Loan Debt Relief

Struggling with personal loan repayments? Our Personal Loan Debt Relief service reviews your existing loans and offers solutions to ease the burden. We work with lenders to restructure or settle your loans at reduced amounts.

Reviews and restructures loans.

Negotiates settlements.

Speeds up debt clearance.

Business Loan Debt Relief

Business owners facing repayment difficulties can benefit from our Business Loan Debt Relief service. We specialize in negotiating with financial institutions to adjust terms, reduce interest rates, or settle outstanding debts.

Renegotiates loan terms.

Prevents asset seizure.

Keeps business operations steady.

Secured Loan Debt Resolution

Secured loans, backed by collateral such as property, require special attention to prevent loss of assets. Our Secured Loan Debt Resolution service provides expert guidance to protect your valuable assets while managing repayments.

Prevents foreclosure.

Adjusts loan terms.

Safeguards property or vehicles.

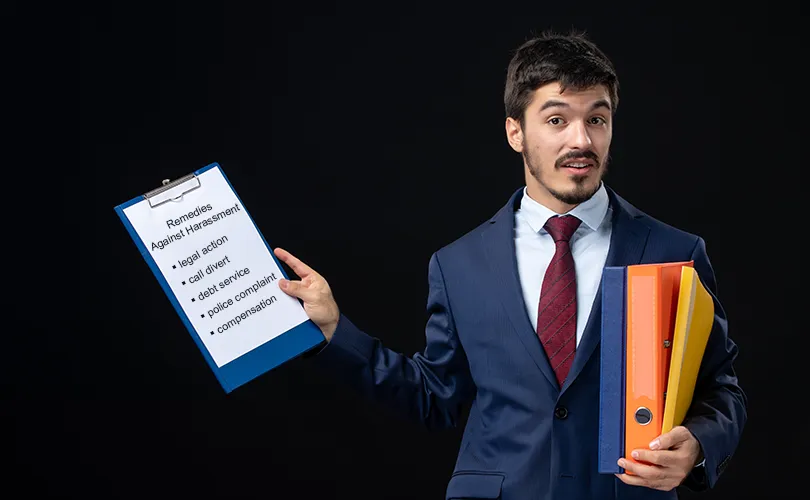

Anti-Harassment Services

Creditor harassment can be emotionally draining and legally questionable.

Our Anti-Harassment Services ensure you are protected against aggressive and unlawful debt collection practices.

Blocks illegal calls.

Sends legal notices.

Defends your rights.

Credit Counselling

Our Credit Counselling service is designed to educate and empower you with effective money management skills. We assess your current financial status, help you understand your credit report, and provide actionable advice to improve your financial health.

Offers budgeting tips.

Reviews credit reports.

Plans debt reduction.

Bankruptcy

When debt becomes unmanageable, bankruptcy can provide a structured legal solution to regain control of your finances. Our Bankruptcy Support Service helps you navigate the legal process under the Insolvency and Bankruptcy Code (IBC), ensuring protection of your essential assets and working toward a fresh financial start with minimal stress.

Guides bankruptcy filing.

Protects essential assets.

Provides a fresh start.

Legal Guidance & Pre-Litigation Support

Before taking legal action, it’s crucial to understand your rights and explore resolution options. Our Legal Guidance & Pre-Litigation Support service helps you assess your situation, draft legal notices, and engage in structured communication with the opposing party.

Drafts legal documents.

Negotiates settlements.

Prevents court escalation.

We’ve helped over 25,000 people regain control of their financial future.

Hear inspiring stories from real clients who broke free from debt and reclaimed their lives.

Frequently Asked Questions

At National Debt Relief, we understand that navigating debt settlement can raise many questions.

How does the debt relief process work?

We start with a free consultation to understand your situation, then create a personalized plan to help you manage and reduce your debt over time.

Will this Effect my credit score?

Some solutions may have a short-term impact, but our goal is to improve your financial health and creditworthiness in the long run.

How long does it take to become debt-free?

Most clients achieve financial freedom within 6 to 12 months, depending on their individual plans and circumstances.

Are there any upfront fees?

We offer transparent pricing with no hidden charges. Details of any fees will be clearly explained before you commit.

.jpg)